wyoming tax rate for corporations

The charts below simply list the income tax rate you would pay in each state if you earned the median income in 2022 as calculated by the US. 7500 25 Of the amount over 50000.

Share Of State Taxes Contributed By Corporate Income Tax Download Table

For non-residents the same types of income are taxable but only the portion of the income that is earned within the City of Wyoming.

. 13750 34 Of the amount over 75000. As a result there isnt a specific tax rate for an S corp like there is for a corporation. Income Tax Rate for C-Corporations.

There are three main models for state small business tax rates. This section summarizes Chapter 2 of Public Act 284 of 1964 the City Income Tax Act. In April 2021 New Yorks highest tax rate changed with the passage of the 20212022 budget.

Marginal Corporate Income Tax Rate. Instead S corps are only subject to. ALL INCLUSIVE AgedSeasoned TEXAS Corporation.

Nearer to the worldwide average. What is the Tax Rate for C Corporations. As discussed above all C-corporations pay a flat 21 tax rate on net business income.

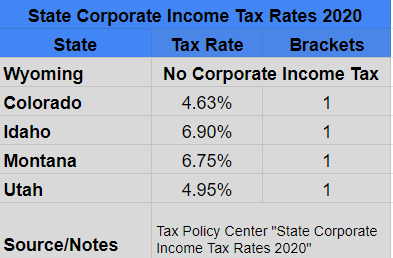

South Dakota and Wyoming have no state corporate income tax. But the companys continuous tax avoidance adds up over time. The Tax Foundation is the nations leading independent tax policy nonprofit.

With the exception of South Dakota and Wyoming all states levy a tax or charge of some sort on business income. Since the Tax Cuts and Jobs Act TCJA of 2017 the statutory corporate income tax ratestate and federal combinedis 258 percent. A corporations receipts minus its allowable deductions equals the corporate profits that are taxed.

The form of communicating a change in rate or manner of pay is not mandated by law however an employer and empoyee may agree to a wage payment arrangement that is other than semimonthly. Californias corporate income tax is a business tax levied on the gross taxable income of most businesses and corporations registered or doing business in California. The top marginal individual income tax rate was permanently increased from 49 to 59 with the addition of a new bracket.

In the United States of America individuals and corporations pay US. With 30 DAYS MARKETING ASSISTANCE INCLUDED IN THE PURCHASE PRICE. The previous 882 rate was increased to three graduated rates of 965 103 and 109.

Over the past four years Amazon reported a total federal tax rate of just 51 percent on over 78 billion of US. The TCJA reduced the federal corporate income tax rate from 35 percent to 21 percent dropping the combined rate from 389 percent to 258 percent and bringing the US. Federal income tax on the net total of all their capital gainsThe tax rate depends on both the investors tax bracket and the amount of time the investment was held.

In most states. Short-term capital gains are taxed at the investors ordinary income tax rate and are defined as investments held for a year or less before being sold. You can read the full text of the legislation on the Michigan Legislature Website.

Amazons 2021 federal income tax payment is comparatively significant for a profitable company that paid less than 0 in the first year of the Trump-GOP tax law. S Corp Tax Rate. And Wyoming 522 while those.

Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels. What is taxable income. Since S corp income isnt taxed at the business level it passes through to the owners individual tax return.

In 2017 the Tax Cuts and Jobs Act reduced the top corporate income tax rate from 35 percent down to 21 percent. TEXAS SUPER CORPORATION AMAZON PRIVATE LABEL PRODUCTS HIGH INCOME GENERATING 4K to 6K NET MONTHLY INCOME DROP SHIP INTERNET E-COM BUSINESS.

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

Individual Income Tax Structures In Selected States The Civic Federation

Corporate Taxes By State In 2022 Balancing Everything

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Corporate Tax In The United States Wikiwand

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Corporate Tax Reform In The Wake Of The Pandemic Itep

State Corporate Taxes Improve The Tax Burden On Corporate Earnings Tax News Daily

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Ernst Young Finds Oregon Has Nation S Lowest Total Effective Business Tax Rate Oregon Center For Public Policy

Corporate Income Tax Definition Taxedu Tax Foundation

Corporate Tax Rates By State Where To Start A Business

The Gaming And Decline Of Oregon Corporate Taxes Oregon Center For Public Policy

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

How Is Tax Liability Calculated Common Tax Questions Answered